For

years I have written articles explaining how the US dollar and financial system

is in a state of crisis and a collapse is inevitable—as early as 2016. Although

I didn’t say it, I believed the collapse would occur in 2015. I was wrong and

could be wrong again. However, a rapidly growing number of highly respected

financial individuals and firms are saying the same thing, so I guess I am in good

company. One of those institutions is Stansberry Research, whose founder has

had an enviable record of forecasting major financial events.

·

In the six months that have passed since then-retiring

House Speaker John Boehner and Senate Majority Leader Mitch McConnell cut a

budget deal with President Barack Obama that suspended the legal limit on the

federal debt until March 15, 2017, the federal debt has increased by more than $1 trillion.

·

It took the US

216 years to create the first $8.5

trillion in debt... then just 8 more years to double that amount.

·

The US National Debt, now at $19.26 trillion, is on

schedule to nearly double during the Obama administration.

·

If you include local, state, corporate and personal debt,

Stansberry warns that our

total debt is an unbelievable $65 trillion,

up from $55 trillion in 2009.

·

Even more

alarming is the realization that the Federal Reserve (Fed) is buying up to 70 percent of US Treasury Bonds

with money it created out of thin air. That’s like loaning yourself a million

dollars that you don’t have and never will.

· Consider that

the Fed literally increased the dollar money supply by 400 percent since 2006—again out of thin

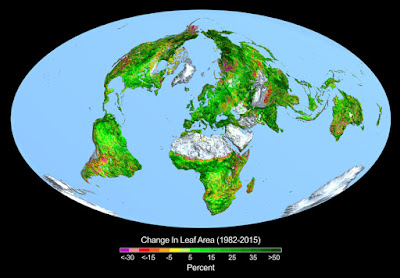

air. The adjacent graph shows what has taken place

over the past few years with the U.S. dollar is something straight out of

Weimar Germany... or the last 20 years in Zimbabwe

· Roughly 75% of

all Americans live from paycheck to paycheck with essentially no savings.

· “We're looking

at a collapse in corporate bonds” claims Stansberry,

“plummeting oil and commodity prices.”

· Research

shows the "too big to fail" banks, the top five largest financial

institutions (the ones that were bailed out in 2008), are now 25% bigger than

they were back then, and more dangerous than ever.

·

Private

businesses have taken on more

debt than any time in the past 12 years, and an incredible 863 companies

that have had their credit rating downgraded last year... the most since

2009.

·

Globally since

2009 world debt has increased by $57 trillion. Twenty years ago global debt of the G20 was $40 trillion.

It skyrocketed to $230 trillion today—nearly an 800 percent increase.

· In recent months

Stansberry

has seen nearly $8 trillion disappear

from world stock markets... and a whopping 70% of investors lost money in

2015. Even Warren Buffett lost $11 billion dollars.

Lear Capital

has been warning for more than a year that “something big” is about to happen.

They provide a list of banks and financial institutions that are stockpiling

massive amounts of gold and silver while telling their customers that investing

in precious metals is not a good idea. Goldman Sachs and HSBC have both stockpiled 7.1 tons

of gold by mid-summer, 2015. At

$1268 per ounce (price on May 9, 2016), 7.1 tons is $263 million.

This is only a small

part of the suicide cliff the US is racing towards. How did it happen? Stansberry

states the obvious: “This is what happens when our government embarks on a

gross, out-of-control experiment, expanding the money supply 400% in just six

years, and more than doubling our national debt since 2006.”

American citizens may

not know the details of the rot our politicians of both political parties have

put us in. However, they know the ‘establishment’ is guilty of something

massive. It is no wonder why the American people are rejecting ‘establishment’

candidates in this year’s presidential election. Assuming Clinton and Trump will be the two candidates in the general election, which one would do better in minimizing the horrible consequences of a collapsing dollar and economy? Clinton seems more interested in women’s rights and big government, but has little experience dealing with hard financial issues. Trump has experience in business related financial issues but is constantly changing his mind on key problems impacting the nation. He has the best chance of getting the nation through this financial crisis, if he would stay on one path and not personally demonize those who disagree with him.

This is the choice you

have. Choose wisely.

Michael

Coffman, Ph.D.